If you’re considering investing in Adidas, you’ve come to the right place. Many investors have seen the potential in Adidas, as well as its potential as an investment. In this article, we’ll explore why investing in Adidas may be a good choice and what to look out for before making an investment decision. We’ll also look at some of the potential risks associated with investing in Adidas. By the end, you’ll have the knowledge and insight necessary to make an informed decision about whether or not Adidas is a good investment for you.

Is Adidas a Good Investment Opportunity?

Adidas is one of the world’s leading sportswear and apparel brands, and is a popular choice among athletes and casual wearers alike. With a global presence and a long-standing reputation for quality, Adidas is an attractive option for investors. This article will explore the potential benefits of investing in Adidas and examine whether or not it is a good investment opportunity.

Adidas has a long history of success, having been founded in 1924. Since then, the company has grown to become one of the most recognizable brands in the world. The brand has a strong presence in the global market, with a presence in over 200 countries and a market capitalization of over $50 billion. Additionally, Adidas has a strong portfolio of products, ranging from performance apparel and footwear to accessories and lifestyle products. This varied product range allows the company to target a wide range of consumers, from athletes to casual wearers.

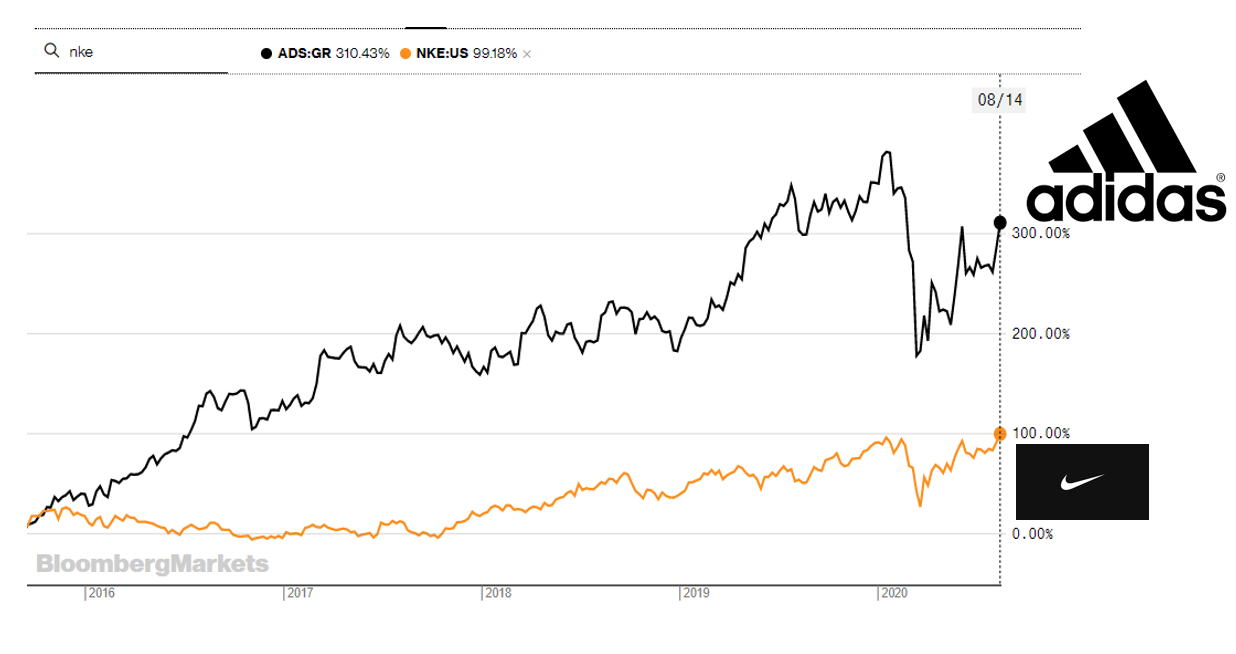

Adidas has consistently delivered strong financial performance over the years. The company has reported increasing revenues and profits since its initial public offering in 1995. In addition, Adidas has generated strong returns for shareholders, with a total return of 6.7% over the past five years. With a strong history of financial performance and a growing portfolio of products, Adidas appears to be a solid investment opportunity.

Adidas’ Competitive Advantages

Adidas has several advantages that make it an attractive investment opportunity. The company has a long track record of success, with a well-established brand and a strong presence in the global market. Additionally, Adidas has a diversified product portfolio and a strong financial performance. These factors give Adidas a competitive edge over other companies in the industry.

Another advantage of investing in Adidas is its strong balance sheet. The company has a strong cash position and low debt levels, which provide it with financial flexibility. This allows Adidas to invest in research and development and marketing initiatives, which can help to drive future growth.

Finally, Adidas has a loyal customer base. The company has a strong brand loyalty, which is a key factor in driving long-term growth. Customers trust the Adidas brand and are willing to pay a premium for its products. This allows the company to generate higher margins and returns on its investments.

Risks of Investing in Adidas

Although investing in Adidas may appear to be a good opportunity, there are certain risks that investors should be aware of. One of the primary risks is the company’s reliance on a few key markets. Adidas generates the majority of its revenues from the United States, China, and Europe, so any changes in these markets could have a significant impact on its performance.

Additionally, Adidas is exposed to currency risk. As the company operates in a large number of countries, it is exposed to changes in exchange rates. This can have a negative impact on its financial performance, as it may need to absorb foreign exchange losses.

Finally, Adidas is subject to competitive risks. The company faces competition from other sportswear brands such as Nike and Puma. These companies have deep pockets and can invest heavily in marketing and product development, which can put pressure on Adidas’ margins.

Conclusion

Adidas is a well-established sportswear brand with a long track record of success. The company has a strong presence in the global market, a diversified product portfolio, and a strong financial performance. Additionally, Adidas has a strong balance sheet and a loyal customer base. Despite these advantages, investors should be aware of the company’s reliance on a few key markets, its exposure to currency risk, and its competition from other sportswear brands.

Top 6 Frequently Asked Questions

What is Adidas?

Adidas is an international sports apparel and footwear company based in Germany. Founded in 1924 by Adolf Dassler, Adidas has grown to become one of the world’s most well-known brands, with a presence in over 160 countries. Adidas produces a wide range of sports products, including footwear, apparel, and accessories, and owns a number of subsidiary brands, such as Reebok and TaylorMade.

Why Invest in Adidas?

Adidas is a great investment option due to its strong brand recognition, global presence, and financial performance. The company has seen strong growth in recent years, with revenues increasing from €14.8 billion in 2016 to €21.1 billion in 2019. Adidas also has a portfolio of popular brands, including its flagship Adidas label, Reebok, and TaylorMade, and a strong presence in the sports apparel and footwear market.

What Risks Are Involved in Investing in Adidas?

There are a few risks associated with investing in Adidas. Firstly, the company is highly dependent on consumer demand for its products, meaning that any changes in consumer tastes or preferences could have a negative impact on the company’s performance. Additionally, the company’s supply chain is global in nature, meaning that it could be exposed to political, economic, and other risks in the countries where it operates. Finally, Adidas is also subject to competition from other major players in the industry, such as Nike and Puma.

What Are the Benefits of Investing in Adidas?

The primary benefit of investing in Adidas is the potential for a strong return on your investment. The company’s strong financial performance and global presence make it a sound investment opportunity. Additionally, Adidas has a portfolio of popular brands, such as its flagship Adidas label, Reebok, and TaylorMade, and is well-positioned to benefit from the growing demand for sports apparel and footwear.

What is Adidas’s Share Price?

Adidas’s share price is currently trading at €204.80, as of June 2021. The company’s share price has seen strong growth over the past five years, increasing from €87.30 in June 2016 to its current level.

How Can I Invest in Adidas?

You can invest in Adidas by purchasing shares of its stock on the stock exchange. You can purchase shares directly from the company, or you can buy them through a broker or online stock trading platform. Additionally, you can also invest in Adidas through mutual funds, Exchange Traded Funds (ETFs), and other investment vehicles.

Adidas Stock Analysis – Buying Now Will Likely Make You Money

Adidas has proven itself to be a solid investment for those looking for a long-term stock market play. With a strong track record of performance that has shown success in both the short and long term, Adidas has shown itself to be a reliable and trustworthy stock option. With continued innovation, marketing and product development, Adidas is in a prime position to continue to deliver returns to investors, making it a smart investment decision for any investor looking to diversify their portfolio.