Adidas is one of the world’s most recognizable and popular sports apparel companies, with a huge presence in the global fashion industry. But recently, Adidas’ stock prices have been going down, leaving many investors and stockholders scratching their heads. What’s behind this sudden drop in the stock’s value? In this article, we’ll explore the reasons why Adidas stock has been going down, and what the company can do to turn it around.

What Factors Led to Adidas Stock Going Down?

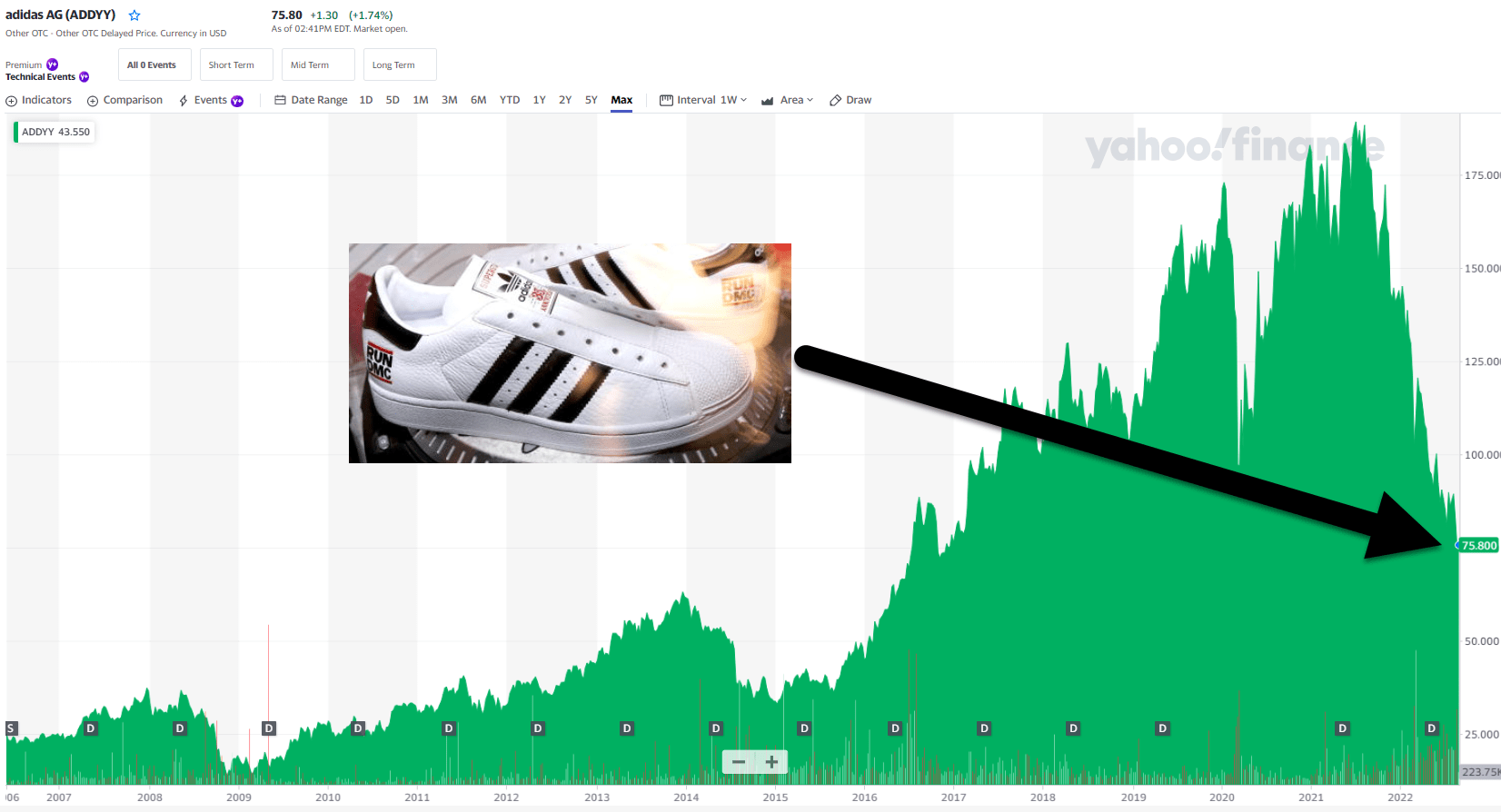

Adidas, the German sportswear giant, has seen its stock prices trending downward since mid-2019. The company’s share price fell from the peak of €248 in January 2019 to around €193 in October 2020. The stock’s decline was caused by a variety of factors, from structural problems to macroeconomic issues.

The company’s internal problems were a major contributing factor to its stock price decline. Adidas had been struggling with a lack of focus on its core business, leading to significant inventory build up and a decrease in sales. This was compounded by the company’s decision to focus on digital channels and its failure to capitalize on the growth of e-commerce. Additionally, Adidas’ supply chain was inefficient and expensive, further driving down its profits.

Adidas also faced macroeconomic issues that contributed to its stock price decline. The company’s stock was affected by the slowdown in global economic growth, as well as a decrease in consumer confidence and an increase in political uncertainty. This led to a decrease in demand for Adidas products, impacting its revenue and profits. Additionally, the US-China trade war and rising tariffs also had an adverse effect on the company’s stock.

Competition from Other Brands

Adidas has been facing increasing competition from rival brands in the sportswear market. Nike, which is the world’s largest sportswear company, has been aggressively expanding its presence in the market. This has put pressure on Adidas to reduce its prices and margins in order to remain competitive. This, in turn, has had an adverse effect on the company’s profits and stock price.

Furthermore, a number of other brands such as Under Armour and Puma have been gaining market share at the expense of Adidas. This has led to a decrease in demand for Adidas products, further impacting its stock price. Additionally, the influx of new technologies such as 3D printing has enabled new players to enter the market and challenge Adidas’ dominance.

Adidas’ Poor Profitability

Adidas’ profitability has been declining in recent years due to a number of factors. The company’s decision to focus on digital channels and its failure to capitalize on the growth of e-commerce has had an adverse effect on its profits. Additionally, the company’s inefficient and expensive supply chain has resulted in increased costs and reduced margins.

Furthermore, Adidas has been facing increasing competition from rival brands, leading to a decrease in demand for its products and a decrease in its profits. The company’s poor performance in some key markets, such as the US and China, has also contributed to its declining profits. This has had a negative impact on the company’s stock price.

Adidas’ Struggles in the US Market

Adidas has been struggling in the US market due to a number of factors. The company has been unable to capitalize on the growth of e-commerce, leading to a decrease in demand for its products. Additionally, Adidas has been facing increasing competition from rival brands such as Nike, Under Armour and Puma.

Additionally, Adidas’ failure to adapt to changing consumer tastes has had an adverse effect on its stock price. The company has been slow to recognize the growing demand for athleisure and streetwear, leading to a decrease in demand for its products. Finally, the company’s inefficient and expensive supply chain has resulted in increased costs and reduced margins, further impacting its stock price.

Impact of the Coronavirus Pandemic

The coronavirus pandemic has had a significant impact on Adidas’ stock price. The company’s stores were closed for several months due to lockdown measures, leading to a decrease in sales and profits. Additionally, the disruption in the supply chain due to the pandemic has resulted in increased costs, further impacting the company’s profits and stock price.

Furthermore, the pandemic has led to a decrease in consumer confidence and an increase in political uncertainty, leading to a decrease in demand for Adidas products. This has had an adverse effect on the company’s stock price. Finally, the pandemic has led to a slowdown in global economic growth, further impacting the company’s stock price.

Few Frequently Asked Questions

1. What is the cause of Adidas Stock Going Down?

The main cause of Adidas stock going down is due to the COVID-19 pandemic. Adidas, like many other companies, has been hit hard by the pandemic, as it has caused global economic instability and market volatility. The pandemic has resulted in a sharp decline in consumer demand and spending, which has in turn led to a decrease in sales and profit for Adidas. Additionally, Adidas has also had to close many of its stores due to the pandemic, which has further impacted its revenue. These factors have all contributed to the decline in the company’s stock price.

2. How has the pandemic affected Adidas?

The pandemic has had a significant impact on Adidas. As mentioned above, the pandemic has resulted in a decline in consumer demand and spending, which has led to a decrease in sales and profit for the company. Additionally, the pandemic has caused Adidas to close many of its stores around the world, which has further impacted its revenue. Finally, the pandemic has caused uncertainty and volatility in the stock market, which has further contributed to the decline in Adidas’ stock price.

3. Is Adidas Stock a Good Investment?

It is difficult to determine whether Adidas stock is a good investment. The stock market is unpredictable, and the future performance of any stock is uncertain. As such, it is important to do your research and assess the risks before investing in any stock. Additionally, it is important to consider the current market conditions and how they may affect the performance of Adidas stock.

4. What Can Investors Do to Minimize Risk?

Investors can minimize risk by diversifying their portfolio. This means investing in a variety of different stocks and other assets, such as bonds and real estate. This will help to spread out the risk and ensure that investors do not suffer too much if one particular stock underperforms. Additionally, investors should research the stock market and stay up to date with the latest news and trends in order to make informed decisions.

5. What is Adidas Doing to Combat the Negative Effects of the Pandemic?

Adidas is taking various steps to combat the negative effects of the pandemic. The company has implemented cost-cutting measures in order to reduce expenses, such as reducing its advertising budget and conducting layoffs. Additionally, Adidas is focusing on its digital strategy, including increasing its online presence and launching new online campaigns. The company is also focusing on expanding its retail presence in order to increase sales.

6. Is Adidas Stock Expected to Rebound?

It is difficult to predict if Adidas stock will rebound. The stock market is unpredictable, and the future performance of any stock is uncertain. However, some analysts believe that Adidas stock is undervalued and has potential for growth in the future, especially as the effects of the pandemic begin to subside. Additionally, Adidas is taking various steps to combat the negative effects of the pandemic, and these efforts may help to improve the company’s performance and stock price in the long-term.

Adidas stock plummets after they drop Kanye West

Adidas stock has been on a downward trajectory for the past few months, but the reasons behind the decline remain unclear. While there is no definitive answer as to why the stock is going down, it can be speculated that the weakening demand for athleisure, a saturated market, and the company’s rising costs are some of the main drivers of the decline. While the future of Adidas stock remains uncertain, investors should watch the market carefully and make informed decisions to protect their investments.